Aesthetic Company review_1_ DaeWoong Pharma

1. Internally developed products critical for margin improvement

One of the biggest differences between global big pharmas and top domestic drugmakers lies in their exposure to internally developed novel drugs. Many global pharmas enjoy high margins because they sell original drugs. With gross margins averaging around 70-80%, these companies can spend around 20% on SG&A expenses and 20% on R&D and still maintain annual OP margins of 30-40%.

Domestic drug companies, on the other hand, have limited exposure to internally developed drugs. Instead, most companies sell generic versions of original drugs whose patents have expired or in-license original drugs from big pharmas. This leads to a high cost of sales and low margins. With gross margins averaging around 40%, domestic companies typically see their OP margins drop to the single digits after spending 20% on SG&A expenses and 10% on R&D. And given that there are minimal differences in products across companies (unless they are original drugs), it is also difficult to reduce SG&A expenses.

Ultimately, the only way for domestic drugmakers to improve their margins is to sell internally developed drugs. Among domestic companies, Hanmi Pharmaceutical and HK inno.N have relatively high margins, mainly because they generate more revenue from in-house developed products than from licensed products.

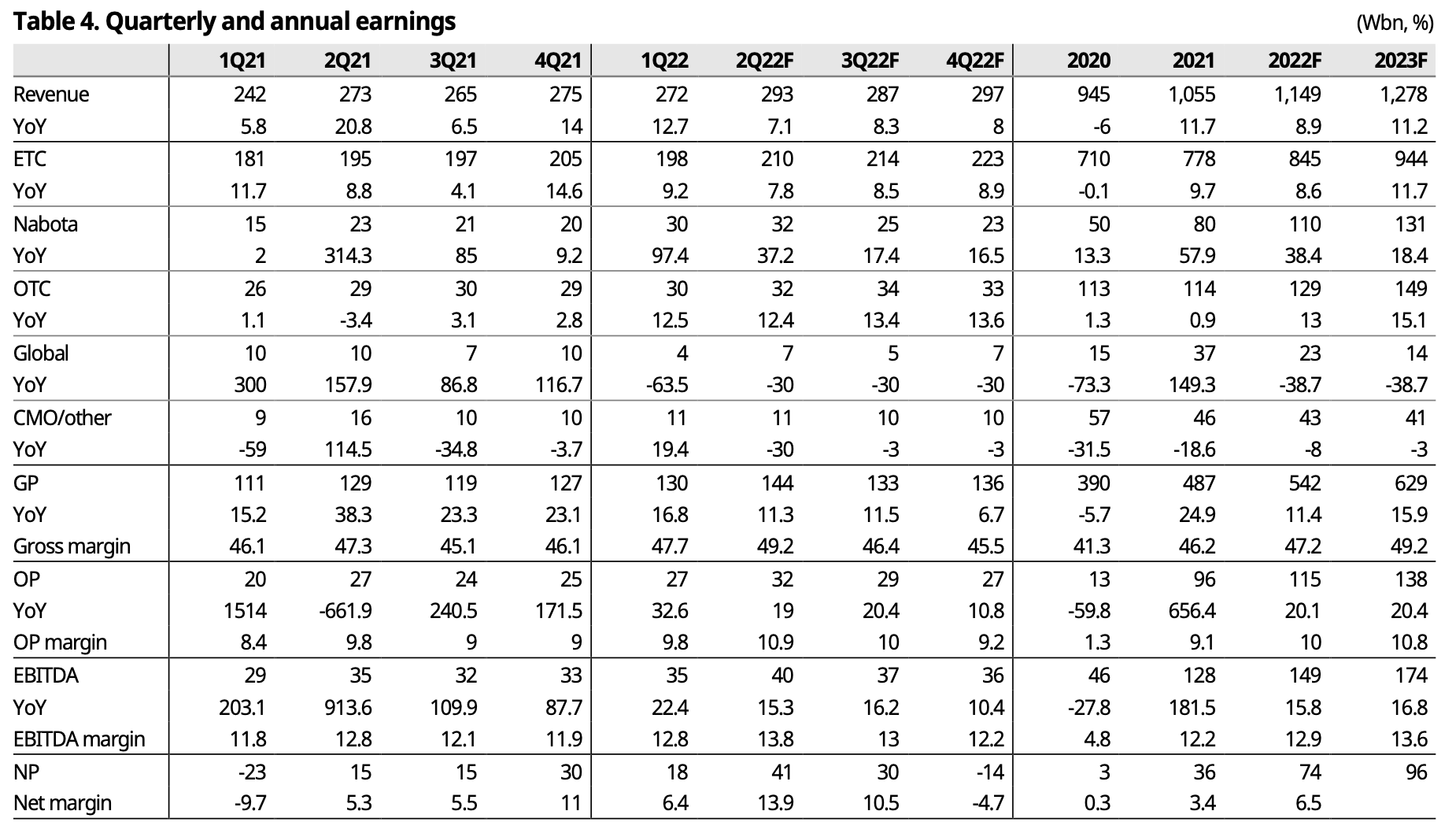

Daewoong Pharmaceutical has recorded annual gross margins of around 40% in recent years. Looking ahead, we expect margins to gradually improve, driven by: 1) the growth of Nabota, an in-house developed botulinum toxin; 2) the launch of fexuprazan (GERD), an in- house developed P-CAB; and 3) the rollout of enavogliflozin (diabetes), an in-house developed SGLT-2 inhibitor.

Nabota is a novel drug that has been newly added to Daewoong Pharmaceutical’s existing portfolio, while fexuprazan and enavogliflozin are internally developed novel drugs that will replace Nexium and Farxiga, which the company has licensed from AstraZeneca.

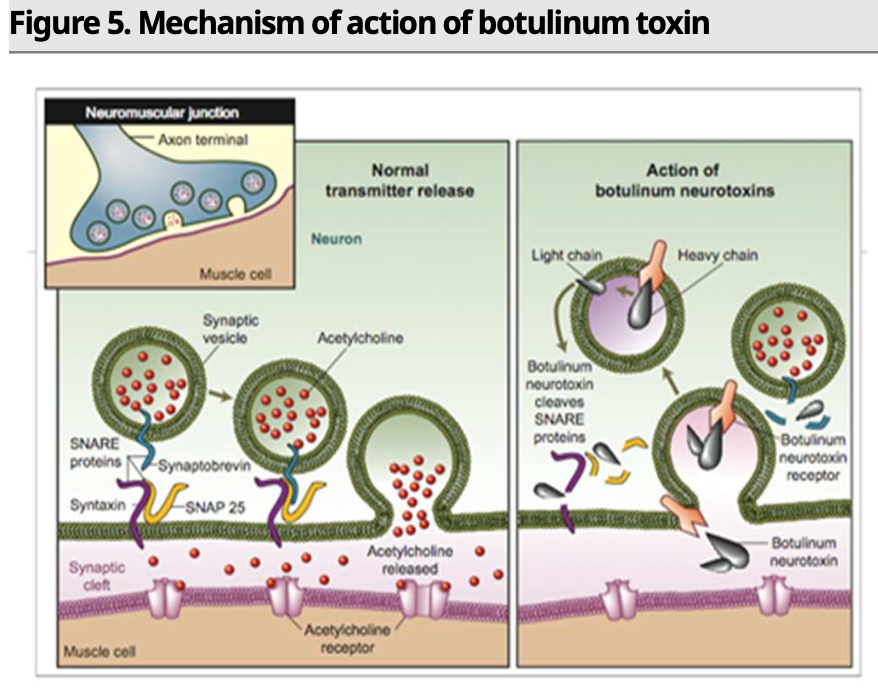

2. Nabota’s overseas advance to gather traction

Botulinum toxin is a drug made from neurotoxins produced by the bacterium botulinum. While mainly known for its cosmetic uses (wrinkle reduction through temporary muscle paralysis), it can also be used to treat medical conditions such as spasticity, blepharospasm, bladder disorders, and migraines. The global botulinum toxin market is led by AbbVie’s Botox (onabotulinumtoxinA), which generates global sales of US$4.7bn (as of 2021).

Nabota is a botulinum toxin developed by Daewoong Pharmaceutical. A global phase 3 trial showed that Nabota had non-inferiority to Botox, with 87.2% of patients having a Glabellar Line Scale (GLS) score of 0 or 1 (vs. 82.8% for the Botox patient group). Nabota is directly sold by the company in the domestic market but is marketed through partners in overseas markets. Daewoong Pharmaceutical’s biggest overseas partner is US-based Evolus (EOLS US), which entered into an agreement with the company in 2013 to obtain the rights to the drug in the US, Europe, Canada, Australia, Russia, South Africa, and Japan. Evolus gained US FDA approval for Jeuveau (Nabota’s US brand name) in 2019. Other overseas partners include Probiomed and Moksha8, which hold the rights in Mexico and Brazil, respectively.

3. P-CAB-based drug fexuprazan poised for commercial success

P-CABs are used for the treatment of GERD. Compared to PPIs (conventional GERD therapy), P-CABs have a faster onset of action and can be taken without food. Helped by such advantages, P-CABs are rapidly penetrating the PPI market. AstraZeneca’s Nexium is a PPI original, while Takeda Pharmaceutical’s Takecab and HK inno.N’s K-Cab are P-CAB originals. Nexium had annual peak sales of around US$5bn, and Takecab brought in revenue of US$1bn in 2021.

Fexuprazan is a P-CAB being developed by Daewoong Pharmaceutical. A domestic phase 3 study on the drug showed positive data, with a mucosal healing rate of 99% at week 8. The drug also demonstrated superior effects in heartburn relief compared to the PPI esomeprazole (Nexium). At day 3, 30.8% of patients in the fexuprazan group reported heartburn relief during the day and at nighttime, compared to 23.4% in the esomeprazole group. For patients with moderate to severe symptoms, the difference was even greater: 22.5% in the fexuprazan group vs. 7.9% in the esomeprazole group.

In Korea, fexuprazan received regulatory approval (under the brand name Fexclu) in Dec. 2021 and is scheduled to be released in 3Q22. The company’s US partner Neurogastrx plans to initiate a US phase 3 study this year. Other partners include Moksha8 (Mexico), EMS (Brazil), Shanghai Haini (China), and Biopas (Colombia, Peru, Ecuador, and Chile).

Daewoong Pharmaceutical is a drug company focused on the development of toxins and novel drugs. Its two main businesses are ETC and OTC. The company was formally established on Oct. 2, 2002 through a split from Daewoong Holdings and went public on Nov. 1, 2002. As of 1Q22, the ETC division accounted for 73% of revenue, while the OTC division and Nabota each made up 11%. Nabota exports have been on the rise, fueled by an increase in indications and entry into overseas markets.

The company’s new drug pipeline includes: 1) fexuprazan, a P-CAB intended for the treatment of GERD; 2) enavogliflozin, an SGLT-2 inhibitor in development as a treatment for endocrine disorders; and 3) DWN12088, a prolyl-tRNA synthetase (PRS) inhibitor in development as a treatment for idiopathic pulmonary fibrosis. In 2021, the company invested W111.2bn in R&D (10.5% of revenue).

In May 2015, Daewoong Pharmaceutical acquired HanAll Biopharma for W104.6bn (30.2% stake) for the development of new biologics. iN Therapeutics, which was spun off from the company (58% stake), is studying iN1011-N17 as a treatment for osteoarthritis. AffyXell Therapeutics is a joint venture in which the company owns a 64% stake, and its lead candidates include AFX-001 and AFX-002 (cell therapies).